Special day

Before and after pics

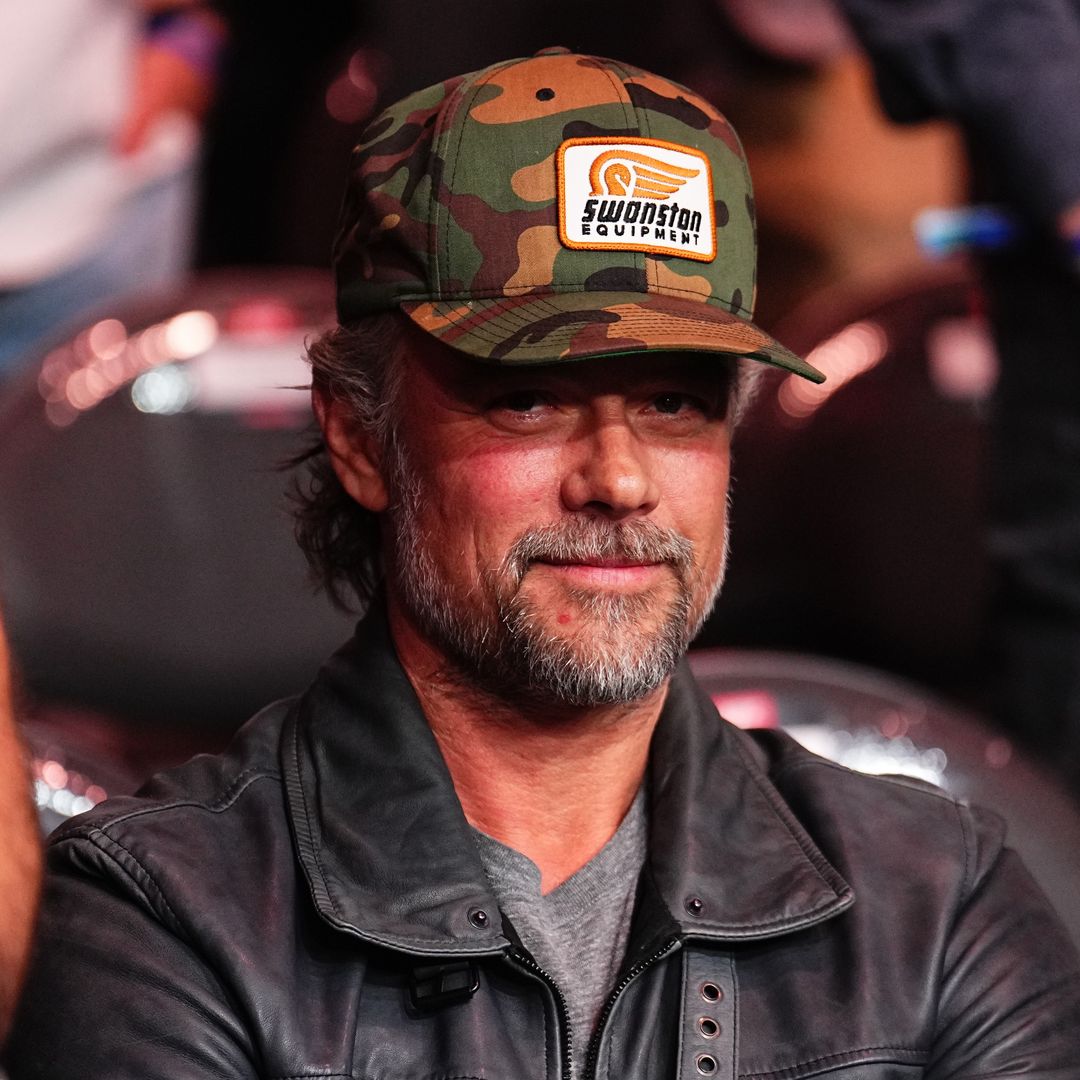

Chris Pratt demolishes historic $12.5 million LA house to build mega-mansion

A-List Transformations

Melissa McCarthy displays slim waist in see-through top after 75lbs weight loss

STAR REELS

ROYALTY

GalleryPrince Harry's squad of close friends - who is in his inner circle?

The Duke and Duchess of Sussex live in Montecito, CaliforniaFASHION

Gallery40 Best dressed celebrities in April 2024: Zendaya, Victoria Beckham, Alicia Keys, and more

Coachella is sure to bring a flurry of enviable looks from the style set this month

9 blue & white striped shirts you’ll repeat-wear throughout 2024

It'll soon become the most worn piece in your wardrobe

The best new season denim skirts to shop now

A denim skirt will slot seamlessly into your spring/summer wardrobe

Victoria Beckham's white suit of dreams in her Mango collection is giving me major Meghan Markle vibes

Channel the Duchess of Sussex in the Victoria Beckham X Mango trouser suit

POP CULTURE

Kim Kardashian admits to unusual sleeping habit as she addresses rumors about herself – watch

The Skims founder set the record straight while promoting American Horror Story: Delicate Part TwoTV AND FILM

HAPPINESS

More HappinessPODCASTS

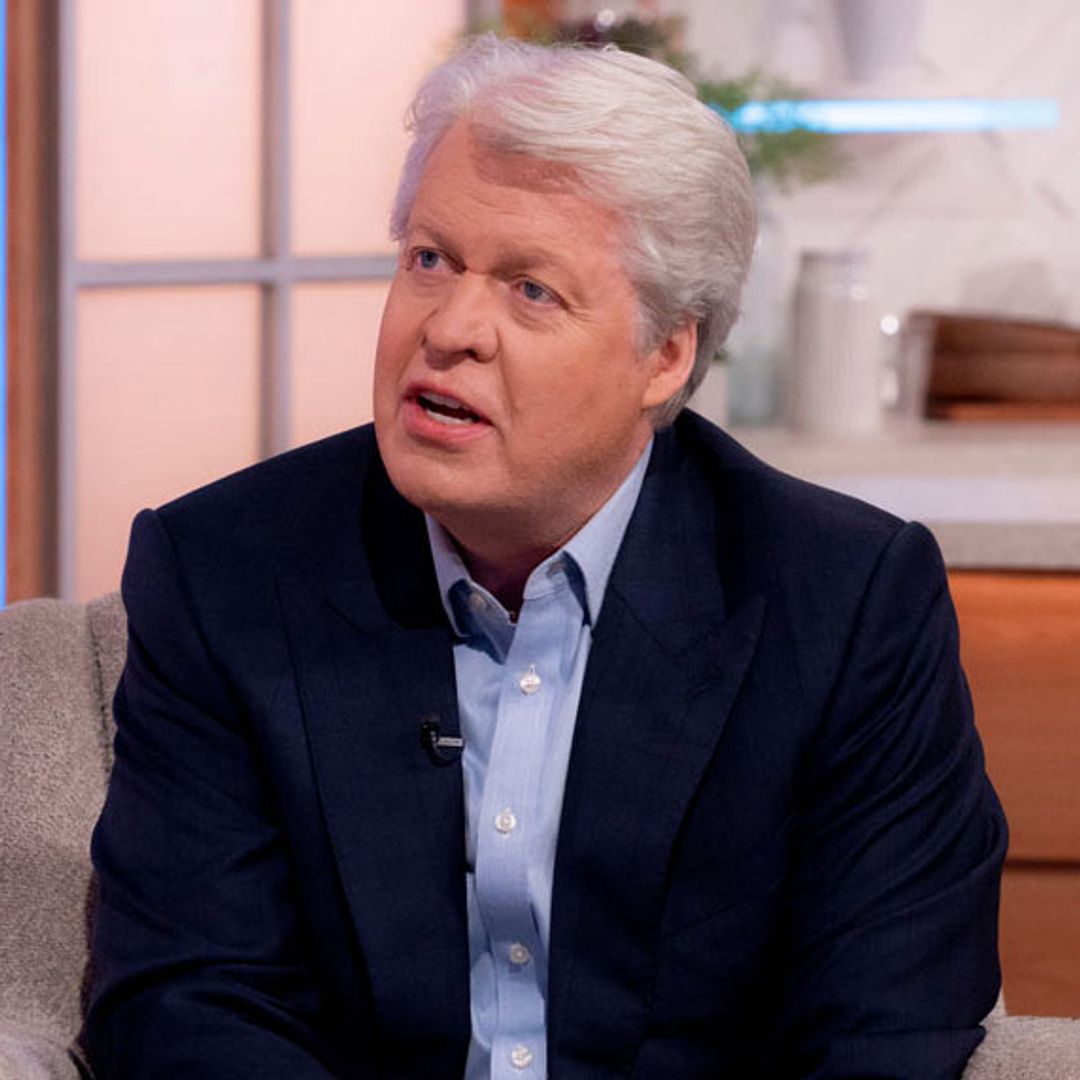

Podcast ArticleScoop's Sam McAlister reveals why she never asked the royal family for permission to write about Prince Andrew's interview

The former Newsnight producer and guest booker, who is portrayed by Billie Piper in the Netflix hit, reveals allFAMILIES

Khloé Kardashian's baby son Tatum sports $400 romper as she dubs him 'mini' Rob Kardashian

The Kardashians star is also a loving aunt to her brother Rob Kardashian's daughterTRENDING

WEDDINGS

Weddings

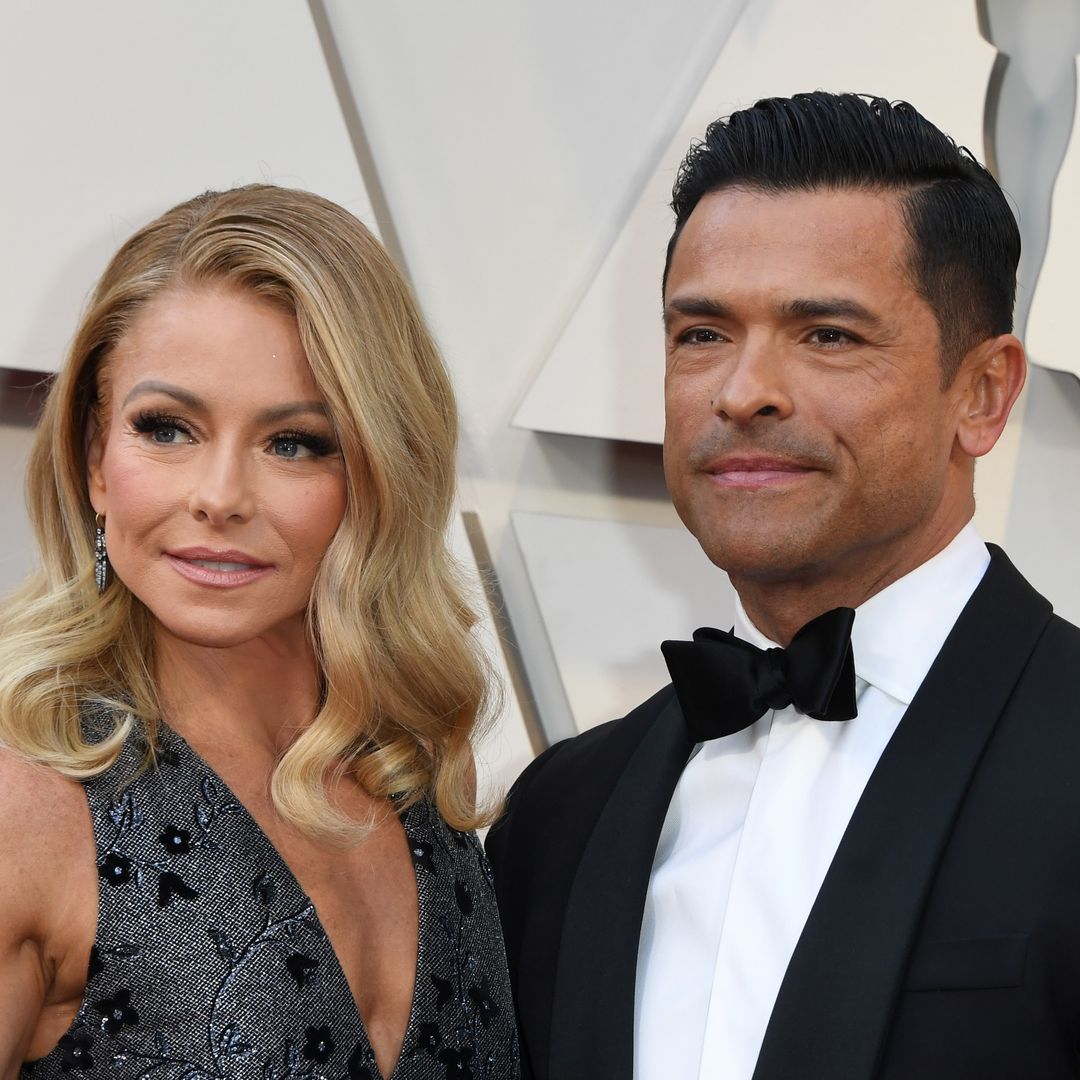

Kelly Ripa, 53, sizzles in sequins in most show-stopping wedding guest dress to date

The Live! with Kelly and Mark star looked glamorous alongside her husband Mark ConsuelosLATEST